Products from Africa

AFRICAN consumers are underserved and overcharged, reckons Frank Braeken, Unilever’s boss in Africa. Until recently, South Africans who craved shampoo made specially for African hair, or cosmetics for black skin, had little choice besides costly American imports. Unilever spotted an opportunity: its Motions range of shampoos and conditioners is now a hit.

AFRICAN consumers are underserved and overcharged, reckons Frank Braeken, Unilever’s boss in Africa. Until recently, South Africans who craved shampoo made specially for African hair, or cosmetics for black skin, had little choice besides costly American imports. Unilever spotted an opportunity: its Motions range of shampoos and conditioners is now a hit.

The Anglo-Dutch consumer-goods giant is making a big effort to tailor products for African customers: affordable food, water-thrifty washing powders and grooming products to fit local tastes. It is also helping other businesses. Last year Unilever opened the Motions Academy in Johannesburg. Each year it will train up to 5, 000 hairdressers who want to open their own salons. It is also a laboratory to test products and to try out new business models. If it works, Unilever plans to replicate it elsewhere in Africa.

Africa already has a $1.8 trillion economy and is forecast to have a population of 1.3 billion by 2020. “Lion” economies such as Ghana and Rwanda have grown faster than South Korea, Taiwan and other East Asian “tiger” economies in five of the past seven years, albeit from a low base.

Unilever is not the only consumer-goods giant moving in. Africa accounts for only 3% of group sales of Nestlé, the world’s biggest food firm, but the Swiss behemoth is betting big there too: its African investments will total SFr1 billion ($1 billion) in 2011 and 2012 against a total capital expenditure of SFr4.8 billion last year. It has 29 factories on the continent and wants to build more. SABMiller, the world’s second-largest beermaker, is planning to invest up to $2.5 billion in Africa over the next five years to build and revamp breweries. In the year to March 2012, the continent (excluding South Africa) was SABMiller’s fastest-growing region, with volumes up by 13%.

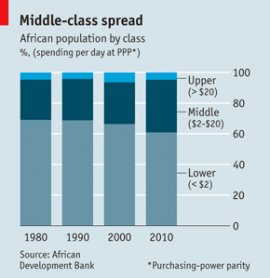

Africa’s attractions stem from its new middle class, loosely defined by the African Development Bank as anyone who spends between and a day in purchasing-power parity terms. The bank estimates that more than 34% of Africans (326m people) fit this description, up from 27% in 2000 (see chart).

Africa’s attractions stem from its new middle class, loosely defined by the African Development Bank as anyone who spends between and a day in purchasing-power parity terms. The bank estimates that more than 34% of Africans (326m people) fit this description, up from 27% in 2000 (see chart).

The challenge is to make stuff such consumers can afford, says Sullivan O’Carroll, the boss of Nestlé South Africa. Nestlé offers wares called “Popularly Positioned Products”. The name may not be snappy but the products are cheap and address common nutritional deficiencies. For instance, Nespray, an instant milk powder, contains calcium, zinc and iron—all essential for children. It is sold in a 250g pouch that costs only a few rand.

Designing products that appeal to locals is only part of the challenge. Even in South Africa, which has the best infrastructure, consumers may be eager but hard to reach. Nestlé delivers directly to spaza shops (informal convenience stores), that make up about 30% of the national retail market. Many of these are in remote areas and owners often cannot afford delivery vans Nestlé has set up 18 distribution centres that deliver to spazas. It charges them the same prices as bigger outlets.

Security is a problem too. Just as Nestlé’s milk powder is fortified with iron, so its distribution centres are fortified with steel. The boss of the one in Soweto (a formerly black-only township that is now part of Johannesburg), has been tied up and held at gunpoint by burglars and threatened several times. Delivery vehicles that collect the spaza owners’ payments, called “cash vans”, used to be adorned with branding. That was like sticking on a sign saying “rob me.” Today they are nondescript white cars.

RELATED VIDEO

Share this Post

Related posts

Products from South Africa

Voted by the people of the South Africa themselves. A large number of consumer goods are coming out every single day. Competition…

Read MoreForum for Agricultural Research in Africa

The Forum for Agricultural research in Africa (FARA) is an apex organization bringing together and forming coalitions of…

Read More