Global economic Slowdown

The Dow Jones Industrial Average fell dramatically in the middle of the week before recovering on Friday. Photograph: Richard Drew/AP

The Dow Jones Industrial Average fell dramatically in the middle of the week before recovering on Friday. Photograph: Richard Drew/AP

What is happening on global markets?

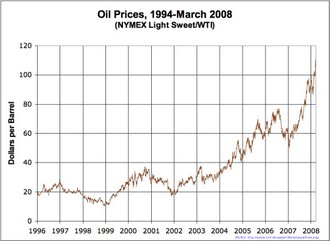

The new year kicked off with a global stock market and commodities rout over worries about the global economic outlook and China’s economy in particular. Plunging prices recovered at the end of last week, partly on reassurances of more stimulus to come from the European Central Bank, but traders are bracing for more volatility. At one point, oil prices fell below $28 per barrel – a 25% drop since the start of the year – on the combined effects of a supply glut and waning demand. Investors have dumped riskier stocks in favour of safe-haven assets, such as gold and government bonds. The FTSE 100 index of London-listed shares bounced back but is still down more than 5% since the start of the year.

What do the experts think?

Cutting its forecasts for global growth, the International Monetary Fund expressed concern about a slowdown in emerging market economies, China’s difficult rebalancing away from an exports-driven economy, lower commodity prices and the ending of ultra-loose monetary policy in the US, which has just raised its interest rates for the first time in almost a decade. The IMF warned that recovery from the financial crisis could be derailed if key challenges are mishandled.

Cutting its forecasts for global growth, the International Monetary Fund expressed concern about a slowdown in emerging market economies, China’s difficult rebalancing away from an exports-driven economy, lower commodity prices and the ending of ultra-loose monetary policy in the US, which has just raised its interest rates for the first time in almost a decade. The IMF warned that recovery from the financial crisis could be derailed if key challenges are mishandled.

The European Central Bank has also pointed to the downward pressure on eurozone growth for similar reasons. Its president, Mario Draghi, hinted the ECB was ready to print more money and cut borrowing costs, to counter those headwinds.

What is China’s role in this?

Worries about China’s true economic strength are at the heart of the jitters. After more than a decade of double-digit growth, during which it overtook Japan to become the world’s second largest economy, things have inevitably slowed down. Last year China’s GDP officially expanded by 6.9%, the slowest pace for 25 years; some say the true picture could well be half that. Other economic data from China has underscored the country’s mammoth task of rebalancing the economy away from reliance on its vast manufacturing sector and exports to a more diverse mix.

A container ship being loaded in Qingdao, Shandong province, China. Photograph: ReutersChina’s woes are being felt in other economies because it is such a big commodities consumer: the slowdown in the world’s biggest energy user is weighing on oil prices. There have also been dramatic swings on China’s stock markets. A debt-fuelled rush of individual investors helped inflate a bubble on China’s main exchanges but it burst last summer. There have been more steep falls in recent weeks. The CSI300 index of the largest listed companies in Shanghai and Shenzhen is down 16% since the start of this year and 42% since a peak last June.

RELATED VIDEO

Share this Post

Related posts

OECD Global Economic Outlook

Achieving strong growth in the global economy remains elusive, with only a modest recovery in advanced economies and slower…

Read More2015 Economic Growth

Global growth is in slow mode, but a recession seems unlikely Bad, worse, or as good as it gets Uncertainty and pessimism…

Read More

The 2008–2012 global recession, sometimes referred to as the late-2000s recession, Great Recession, the Lesser Depression, or the Long Recession, is a marked global economic decline that began in December 2007 and took a particularly sharp downward turn in September...

The 2008–2012 global recession, sometimes referred to as the late-2000s recession, Great Recession, the Lesser Depression, or the Long Recession, is a marked global economic decline that began in December 2007 and took a particularly sharp downward turn in September...

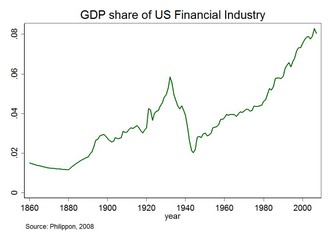

The 2007–2012 global financial crisis, also known as the Global Financial Crisis and 2008 financial crisis, is considered by many economists to be the worst financial crisis since the Great Depression of the 1930s. It resulted in the collapse of large financial...

The 2007–2012 global financial crisis, also known as the Global Financial Crisis and 2008 financial crisis, is considered by many economists to be the worst financial crisis since the Great Depression of the 1930s. It resulted in the collapse of large financial...